Report Abstract

High-energy SMD (Surface Mount Device) varistors represent a significant evolution in the circuit protection family. While they share the same fundamental protection mechanism as traditional leaded varistors, distinct manufacturing processes grant them unique application advantages. Their surface-mount form factor, miniaturization, and high-energy capabilities align perfectly with current electronics trends toward compact, lightweight, and automated production. Furthermore, their high surge energy tolerance and excellent consistency allow them to serve as viable alternatives to Transient Voltage Suppressor (TVS) diodes in specific scenarios.

Beyond standard protection, high-energy SMD varistors offer distinct characteristics compared to Gas Discharge Tubes (GDT) and TVS diodes—particularly in high-voltage, high-current applications where they hold an irreplaceable advantage. Their stability at high temperatures and non-flammable failure modes make them ideal for sectors with stringent safety and thermal requirements, such as automotive electronics and 5G communications.

While China’s production of high-energy SMD varistors is emerging relative to the international market—where foreign enterprises currently dominate high-end sectors like automotive and industrial control—domestic development is accelerating. The rise of New Energy Vehicles (NEVs), 5G, Smart Homes, and the widespread adoption of third-generation semiconductors (GaN) has created new demands for high voltage tolerance, low clamping voltage, and enhanced safety. This article explores how high-energy SMD varistors are evolving to meet these technological trends.

The Trend Toward SMD Circuit Protection

As a critical component in circuit protection, the varistor’s core function is to absorb transient overvoltage, suppress surge currents, and stabilize circuit operation. Utilizing non-linear voltage-current characteristics, the device maintains a high-resistance state under normal voltage but rapidly switches to a low-resistance state when a threshold is exceeded. This shunts overcurrent to ground, protecting sensitive electronics. As electronic products become smaller, thinner, and lighter, the demand for SMD, miniaturized, and high-energy components has grown, positioning high-energy SMD varistors as a key focus for the market.

Market Outlook Market forecasts indicate the Chinese SMD varistor market reached 8.2 billion RMB in 2023. With a projected CAGR of 12.8%, the market is expected to surpass 20 billion RMB by 2030. Structurally, automotive-grade products are set to rise from 28% (2023) to 45% (2030), with industrial-grade products stabilizing around 35%.

Policy Landscape The “14th Five-Year Plan” emphasizes breaking technical bottlenecks in high-end electronic components. While developed nations have achieved chip component rates over 80%, China sits at approximately 30% [1]. Domestic self-sufficiency for SMD varistors is projected to rise from under 30% to 75% or more by 2025, creating a significant window for domestic substitution.

Product Classifications SMD varistors are generally categorized into two types:

- ESD Protection Type: Protects ICs and signal circuits from electrostatic discharge.

- High-Energy Type: Designed to replace plug-in (leaded) varistors (5D, 7D) and TVS diodes, specifically for power surge protection where space and aesthetics are critical. This article focuses on this high-energy category.

Replacement Potential According to authoritative market research, global shipments of leaded varistors jumped from 10 billion units in 2003 to over 50 billion in 2019. If high-energy multilayer SMD varistors capture just 10% of the leaded market (estimated at 72 billion units globally), this represents a market of 7.2 billion units annually. Similarly, substituting high-power TVS diodes presents a 1.9 billion RMB opportunity (based on 2024 global estimates) [2].

Historically, leaders like Littelfuse, Panasonic, and EPCOS promoted these components [3]. However, adoption was slowed by cost and limited lightning surge capability. Recent advances in Low Temperature Co-fired Ceramic (LTCC) technology and the use of low-silver/palladium or pure silver internal electrodes have reduced costs while increasing current density. This has opened doors in high-voltage fields, such as LED lighting, where estimated Chinese shipments reached 1 billion units in 2024.

Key Application Growth

- Consumer Electronics: Smartphones (approx. 1.2 billion units/year) drive massive demand for charger protection.

- Smart Home: Whole-home intelligence increases varistor usage from ~5 per home to ~30.

- 5G Infrastructure: 5G base stations require significantly more protection (58 units per AAU vs. 20 in 4G), particularly in PMUs and Antenna Tuning Units.

- New Energy Vehicles (NEV) & Storage: 800V high-voltage platforms are pushing voltage ratings from 650V to 1200V. However, the lack of domestic manufacturers with IATF 16949 certification remains a bottleneck [4].

I. Replacing Leaded Varistors and TVS Diodes

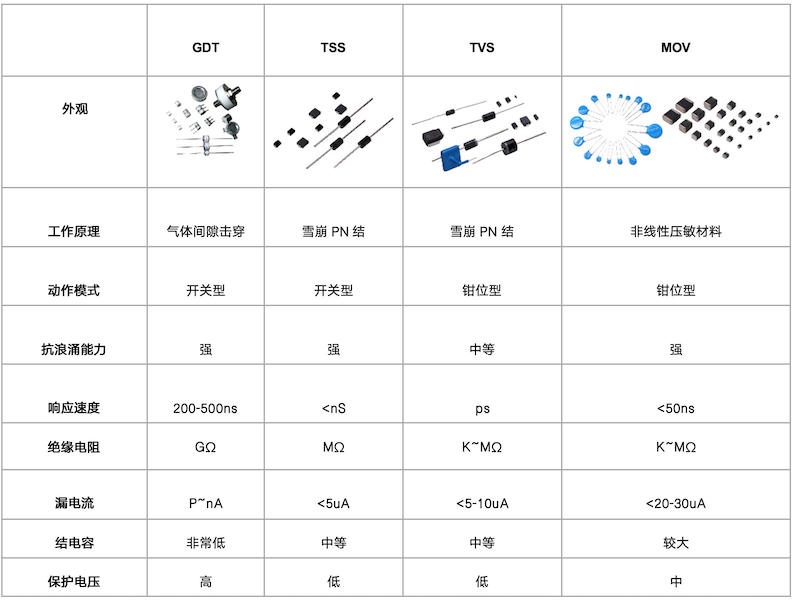

1. Comparison of Protection Devices

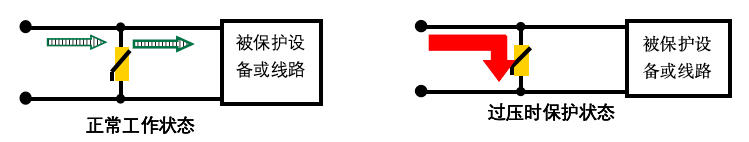

Common overvoltage protection devices operate on the same principle: they are parallel-connected components that remain open (high impedance) during normal operation and short (low impedance) during overvoltage events to clamp voltage and divert current.

- Clamping Devices: MOV (Metal Oxide Varistor), TVS (Transient Voltage Suppressor). Best for power supply protection.

- Switching Devices: GDT (Gas Discharge Tube), TSS (Thyristor Surge Suppressor). Best for signal protection due to low capacitance, but require secondary protection due to high firing voltages.

Performance Hierarchy:

- GDT: Highest surge energy, but high clamping voltage.

- TVS: Lowest surge energy, but most precise clamping (best for sensitive ICs).

- Varistor (MOV): Sits in the middle—better surge handling than TVS, better clamping precision than GDT.

High-energy SMD varistors retain the high surge capacity of standard MOVs but offer the benefits of surface mounting (automation-friendly) and improved consistency. They are superior to TVS in high-voltage, high-current scenarios and offer better high-temperature stability.

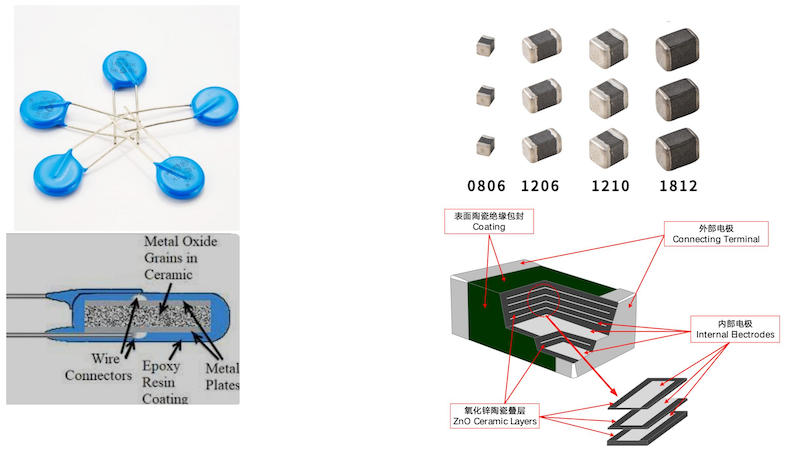

2. Structural & Manufacturing Differences

- Leaded Varistors: Made via spray granulation and dry pressing, followed by epoxy coating. Sintered at ~600°C.

- High-Energy SMD Varistors: Manufactured using a multilayer stacking process (similar to MLCCs). Thin tapes with printed electrodes are laminated and isostatic pressed. Sintered at 600-700°C.

Key Advantage: The clean, fine-pitch manufacturing of SMD varistors ensures better consistency. Unlike leaded varistors, where performance can degrade significantly after high-temperature processing (like soldering), high-energy SMD varistors maintain stable voltage and leakage current characteristics. Furthermore, they are solid ceramic bodies with no flammable materials, ensuring they do not catch fire upon failure.

3. Case Studies: Substitution in Action

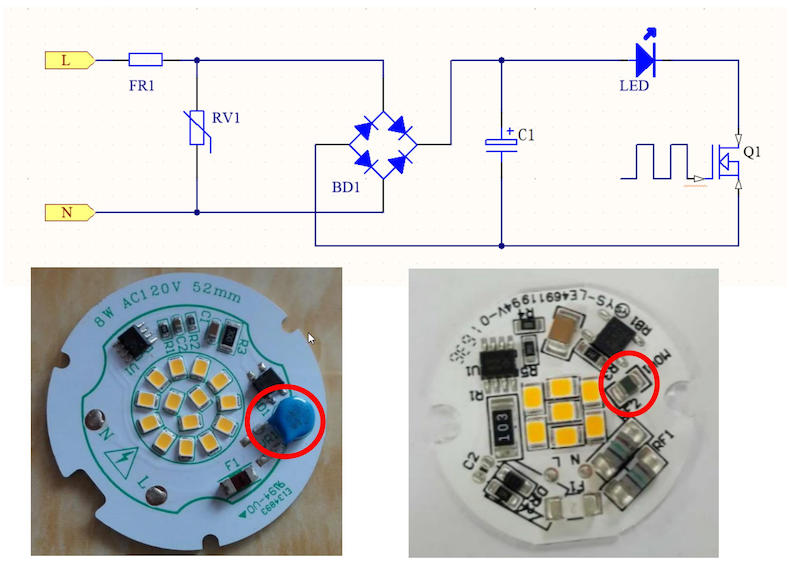

A. LED Lighting (Replacing Leaded MOVs)

In the Linear DOB (Driver on Board) trend, space is premium. Traditional leaded varistors are bulky, block light, and are difficult to automate. When bent to fit, their insulation can degrade due to heat from the aluminum substrate.

- Solution: High-energy SMD varistors allow for automated placement, do not block light, and solve insulation/spacing issues.

- Current Adoption: Widely used in smart home devices, EV charging guns, rail transit, and smart meters.

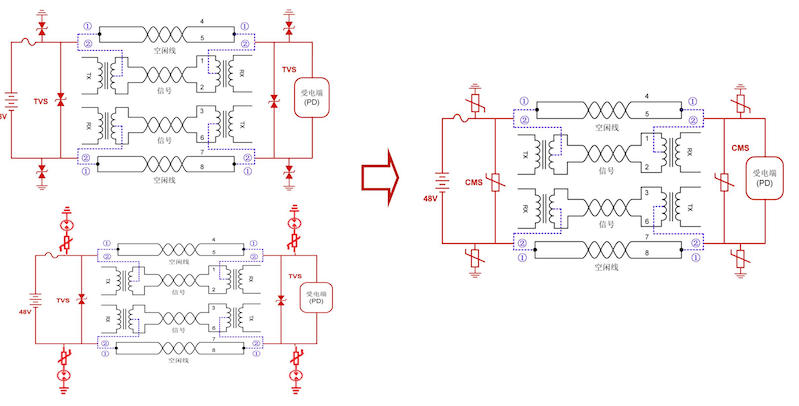

B. PoE Protection (Replacing TVS)

In Power over Ethernet (PoE) security and communication applications (e.g., 48V systems):

- Old Way: GDT + Leaded MOV (Bulky, complex) or TVS (Temperature sensitive, large footprint).

- New Way: High-energy SMD varistors.

- Benefit: Smaller footprint, higher surge capability per unit volume, and stable performance at 125°C. Major players like Huawei, ZTE, Hikvision, and Dahua have adopted this solution for base station and camera protection.

II. Unique Application Scenarios

High-Voltage Equipment Protection (GaN Era)

With the proliferation of Gallium Nitride (GaN) semiconductors, power supply voltages are increasing (>650V). Traditional protection components struggle here: leaded MOVs are too large for modern compact designs, and TVS diodes cannot handle the high currents without expensive, bulky stacking.

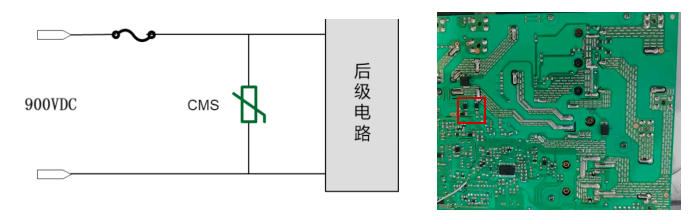

Example: Induction Cooker IGBT Protection

- Scenario: 900V working voltage, requiring 1200V protection.

- TVS Solution: Requires 3x SMBJ400CA in series. Low surge capability (10A @ 8/20μs).

- SMD Varistor Solution: Single 1210 package component. Rated for 1200V. Surge capability: 100A.

- Result: 1/10th the volume, 5x the surge capability, lower cost, and better high-temp stability.

Similar applications are found in Photovoltaic (PV) inverters, high-voltage charging piles, and Smart Grid applications.

III. Development Trends and Innovations

While international brands dominate the high-end automotive and industrial markets, domestic Chinese companies are closing the gap. The industry is moving toward High Voltage, High Current, Low Clamping Voltage (Residue Voltage), and High Safety.

1. Automotive Electronics (Motors & Load Dump)

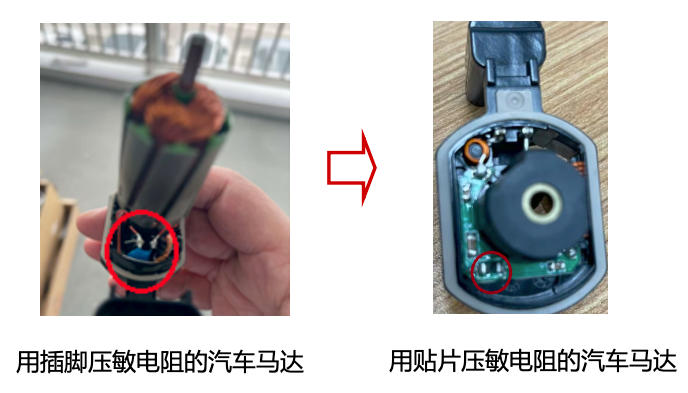

Modern vehicles have up to 40 motors (windows, wipers, seats). Traditional noise suppression uses leaded varistors, which require manual soldering and have poor consistency.

- Trend: Shift to SMD for automation and AEC-Q200 compliance (-40°C to +125°C/150°C).

- Load Dump (ISO 7637): Protecting 12V/24V systems against battery disconnection. SMD varistors offer superior vibration resistance and thermal stability compared to TVS in these harsh environments.

2. PD Fast Charging (Low Clamping Voltage)

The fast-charging market (billions of units annually) demands UL62638 compliance:

- Requirement: Withstand 480VAC, yet keep clamping voltage <800V under 1.5KV/750A surge.

- Challenge: Standard varistors often have high clamping voltages. TVS stacks are too thick (>10mm) and expensive.

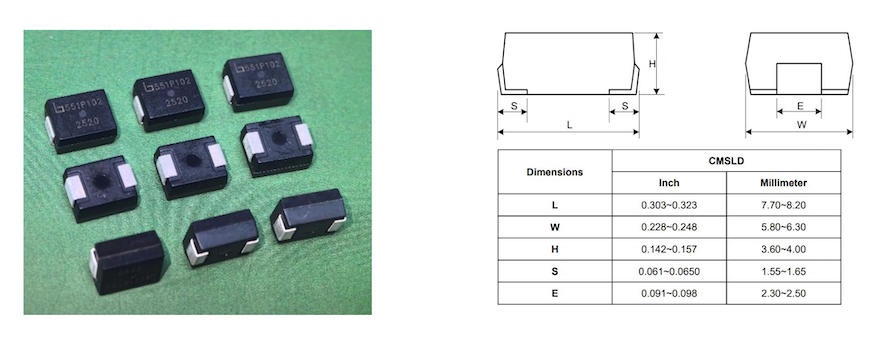

- Innovation: Company B (Boarden) has developed a Low-Residue High-Energy SMD Varistor.

- Specs: <5mm height (SMC footprint).

- Performance: Withstands 440VAC (breakdown >622V), yet limits surge residue to <800V at 2000V impact.

- Efficiency: Ultra-low leakage supports the industry push toward 35mW standby power consumption (down from 150mW).

3. BMS (Battery Management Systems)

BMS engineers face a dilemma: High standoff voltage reduces false triggering but increases clamping voltage (risking MOS damage). To lower clamping voltage, engineers often parallel multiple TVS diodes, which introduces “current hogging” risks (one diode failing first).

- Solution: A single Low-Residue High-Energy SMD Varistor.

- Impact: One SMD varistor (e.g., CMSL series) can replace up to 6 parallel TVS diodes.

- Data: A generic SMA-sized SMD varistor can handle 500A (8/20μs) with a clamping voltage of 120V, outperforming a standard SMCJ100CA TVS (124A capability, 162V clamping).

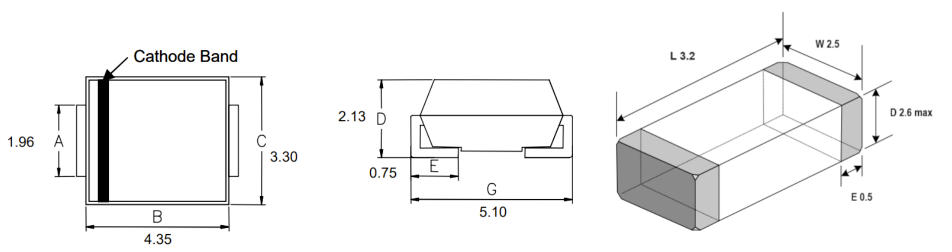

4. Fail-Safe Open Circuit Technology

A critical innovation is the Fail-Safe Open Mode. Traditionally, varistors fail as a short circuit, risking fire. Designers usually add a series fuse, consuming space.

- New Design: Leveraging the multilayer manufacturing process, a fuse structure is integrated directly into the internal electrode design of the varistor.

- Mechanism: Using the Zinc Oxide dielectric (instead of Alumina used in chip fuses) modifies heat dissipation. By calibrating the electrode geometry, the component acts as a varistor under surge but fuses open (“blows”) safely under sustained overcurrent/short-circuit conditions.

- Result: A single component offering overvoltage protection with built-in fire safety.

IV. Summary

High-energy SMD varistors are not just miniaturized versions of their leaded counterparts; they are a distinct class of protection devices filling the gap between GDTs and TVS diodes. They are essential for the safety of third-generation semiconductors (GaN), automotive systems, and miniaturized consumer electronics.

Currently, the supply chain for high-end automotive and industrial varistors is dominated by international players. However, domestic innovation in achieving high voltage tolerance, low clamping voltage, and integrated safety (fail-safe) is accelerating. These advancements position high-energy SMD varistors as a cornerstone of next-generation circuit protection.

References:

- Chen Jinqing, Research and Industrial Status of Domestic and Foreign Chip Electronic Components.

- Electronic Protection Components Newsletter, 2025, Issue 1.

- Chen Tao, Fu Qiuyun, et al., ZnO Varistors and their Chip Technology, Modern Technical Ceramics.

- 2025-2030 China Chip Varistor Industry Market Operation Status and Investment Direction Research Report.